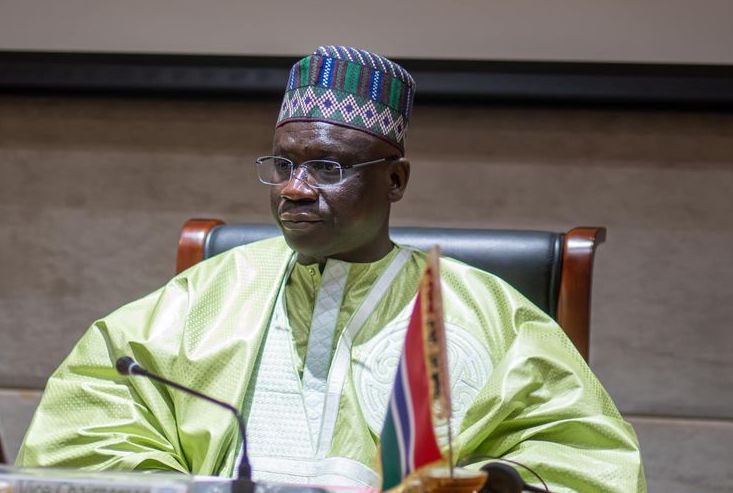

Gambiaj.com – (Banjul, The Gambia) – The Governor of the Central Bank of The Gambia, Buah Saidy, has firmly denied allegations that the institution disbursed $100 million to handpicked businesses at the height of the COVID-19 pandemic. Speaking on West Coast Radio’s “Coffee Time with Peter Gomez,” Governor Saidy clarified the role of the Central Bank in facilitating foreign exchange access for essential imports, emphasizing that the bank did not directly provide funds to any business.

The controversy stems from statements made by the Minister of Trade, Industry, Regional Integration, and Employment in the National Assembly, which indicated that specific businesses received foreign exchange support from the Central Bank to import essential commodities. Some reports suggested that up to $100 million from the country’s international reserves was involved, leading to public scrutiny and speculation.

Central Bank’s Role in Stabilizing Prices

Governor Saidy explained that the Central Bank’s primary mandate is price stability, and during periods of supply constraints caused by the COVID-19 pandemic and the Russia-Ukraine war, the institution intervened to ensure the availability of basic commodities such as rice, sugar, edible oil, fuel, and even onions.

He described how the Central Bank collaborated with commercial banks to issue Letters of Credit (LCs) to businesses, enabling them to import essential goods. “No central bank in the world deals directly with private sector businesses,” he stated, dismissing claims that the institution provided direct financial assistance to companies.

A key intervention, according to Governor Saidy, was the facilitation of an agreement between The Gambia and India to import 100,000 metric tons of rice in 2023. This negotiation took place at a time when India was restricting non-basmati rice exports due to domestic supply concerns. The Central Bank, in coordination with the Ministry of Trade and Gambian diplomats, helped businesses secure LCs despite a challenging foreign exchange environment.

Foreign Exchange Challenges and Management

The Governor pointed out that The Gambia has been experiencing foreign currency shortages due to the country’s high import dependence and limited export revenue. The primary sources of foreign currency—timber and cashew exports—were affected by Senegalese government policies restricting the re-export of these commodities through The Gambia. This diversion of trade resulted in a significant reduction in foreign exchange inflows, exacerbating liquidity challenges.

Despite these constraints, Governor Saidy asserted that the Central Bank managed reserves strategically to prevent excessive depreciation of the dalasi. He highlighted that when businesses faced difficulties obtaining foreign exchange for imports, they approached their commercial banks for LCs. If a bank lacked sufficient foreign currency to honor an LC, the Central Bank would sell forex to the bank, which then facilitated payment for the import transaction. “We did not deal with any business directly; we only worked through the banks,” he reiterated.

Transparency and Confidentiality in Banking Operations

Addressing concerns over transparency, Governor Saidy stated that while the Central Bank remains accountable to the public, certain banking transactions, especially those involving third-party businesses, are confidential under banking regulations. He explained that media requests for details on specific businesses that received forex allocations could not be honored due to banking confidentiality laws.

He also refuted claims that all forex requests were approved, noting that the Central Bank had rejected several applications that did not meet its criteria. “Many people felt entitled to foreign exchange support, but it is our responsibility to be stringent and ensure that only valid applications are approved,” he said.

Inflation and Price Stability Efforts

Governor Saidy acknowledged that inflation, which stood at 9.99% in September 2024, remains a challenge. However, he attributed recent price increases to administered prices rather than monetary policy inefficiencies. He assured the public that the Central Bank remains committed to stabilizing prices and ensuring a resilient financial system.

In conclusion, the Governor dismissed the notion that the Central Bank had handed out $100 million to businesses as incorrect and misleading. He emphasized that the institution remains focused on maintaining economic stability and ensuring that foreign exchange reserves are managed prudently in the national interest.