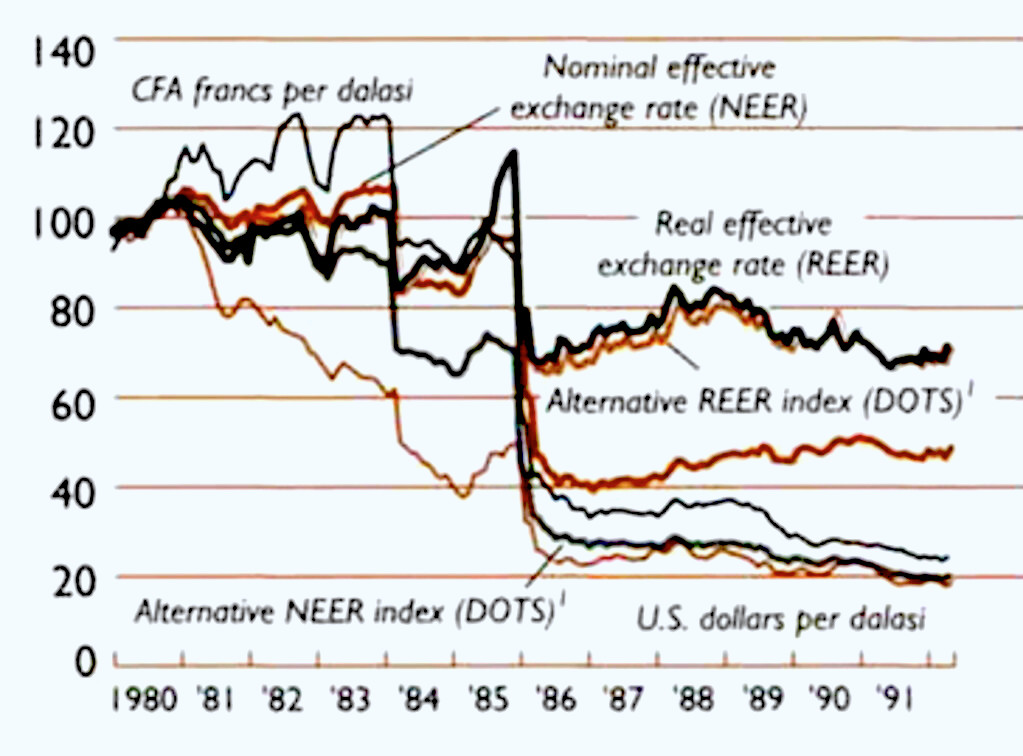

Central Bank Governor Buah Saidy disclosed that the the government’s internal debt grew by 8.4% while the Gambian Dalasi underwent a minor decline compared to major international currencies in 2023 during the quarterly Monetary Policy Committee meeting update. In relation to the US dollar, the Dalasi lost 3.8 percent of its value; with the Euro, the loss is 10.8 percent; with the GBP, the loss is 12.7 percent; and with the CFA, the loss is 14.2 percent.

Governor Saidy emphasized that despite these slight depreciations, the dalasi is generally stable. He emphasized the strong overseas reserves held by the Central Bank, which stood at US$475.3 million as of January 2024—more than enough to handle more than five months’ worth of potential imports.

“The Dalasi is still steady and will only weaken slightly against the main currencies used in international trade in 2023. It lost 3.8 percent versus the US dollar, 10.8 percent against the euro, 12.7 percent against the GBP, and 14.2 percent against the CFA. As of January 2024, CBG has US$475.3 million in overseas reserves, which is more than enough to cover more than five months’ worth of potential imports of products and services, he stated.

In addition, Governor Saidy stated that preliminary evaluations of government spending projects showed that the total deficit (including grants) will drop from D6.9 billion (5.7 percent of GDP) in 2022 to D4.4 billion (3.1 percent of GDP) in 2023. However, in contrast to D15.3 billion (12.5 percent of GDP) the year before, the entire budget deficit (excluding grants) increased to D18.5 billion (12.9 percent of GDP) in 2023.

“In 2023, a total of D31.9 billion (22.2 percent of GDP) in revenue and grants were mobilized, representing a 39.4% increase from the previous year. The rise in domestic revenue and grants is reflected in the rise in total revenue and grants. Between 2022 and 2023, total spending and net lending climbed by 21.8 percent to reach D36.3 billion. (25.3 percent of GDP), from D29.8 billion (24.3 percent of GDP), driven by the increase in development expenditures that were largely externally financed,” he said.

The governor of the Central Bank revealed that, from D38.1 billion (or 31.7 percent of GDP) in 2022 to D41.3 billion (or 29.4 percent of GDP) in 2023, the government’s internal debt grew by 8.4%.

“The increasing issuance of medium-term government bonds and Treasury bills to settle maturities and support the budget mostly explains this increase. Because more than half of the debt stock matures in less than a year, short-term debt made up 58.5 percent of the total domestic debt stock, while medium-to long-term debt made up 41.5 percent. This indicates a significant refinancing risk, the speaker noted.