Gambiaj.com – (BANJUL, The Gambia) – Commissioner General Yankuba Darboe of the Gambia Revenue Authority (GRA) has urged consumers to boycott excisable products that do not carry a digital tax stamp. This call to action is aimed at protecting local industries, increasing tax revenue, reducing the country’s heavy reliance on imports, enhancing the Dalasi’s value, and creating jobs.

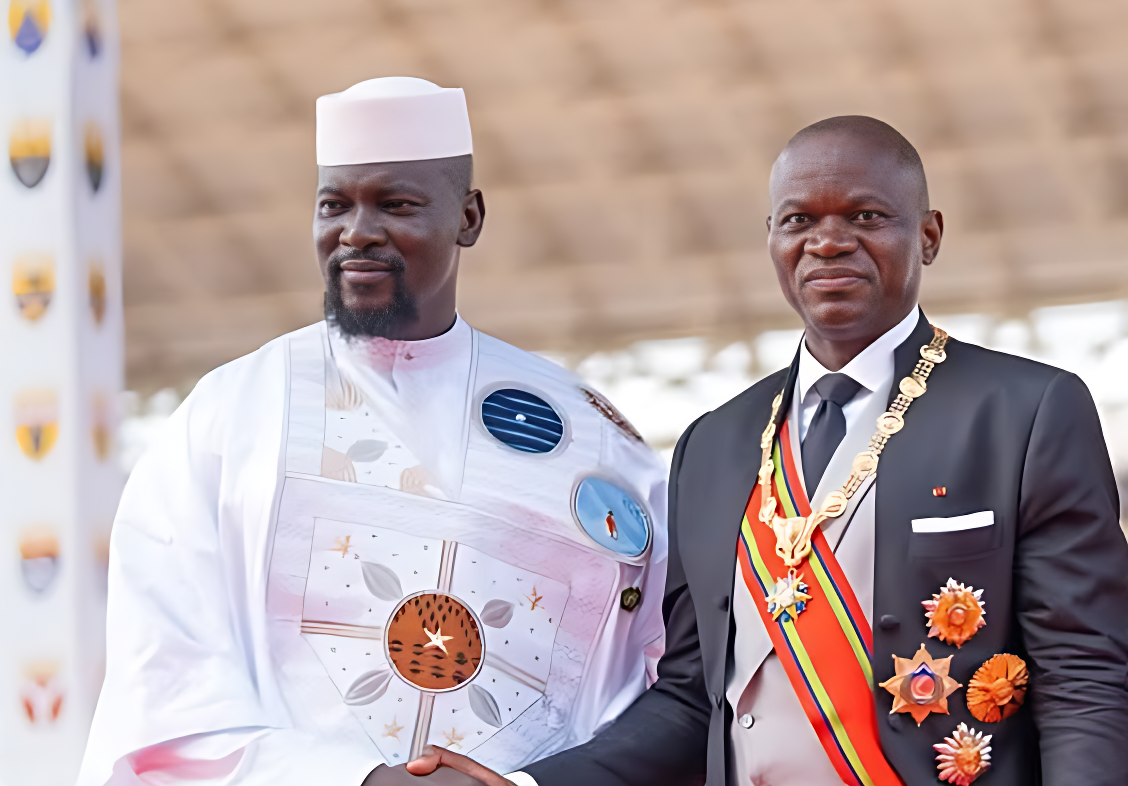

In January, the GRA introduced digital excise stamps to facilitate tax collection, ensure transparency, and enhance accountability in tax resource management. CG Darboe, accompanied by GRA officials, visited the Bel Water and Beverage Company in Bonto and Gambega in the Greater Banjul Area to assess compliance with the new regulation.

During his visits, Darboe commended both companies for their voluntary adherence to the digital excise stamp requirements. He emphasized the importance of supporting local industries by consuming locally-manufactured goods.

“If we want to help our local industries grow, we must patronize them. We need to help them grow. I urge importers of beverages to look inward and contact Bel. We heard that they have eight brands of drinks,” Darboe stated at Bonto.

He called for a boycott of excisable products lacking the digital tax stamp and encouraged a nationwide campaign to ensure that all consumed products comply with the new regulations.

“Let’s have a campaign that any product we consume must have a digital tax stamp. This is a country that we want to build, and there is no going back,” Darboe emphasized at Gambega. “What we are doing now [tax reforms] is for posterity. We have a vision, mission, and drive, and we will work.”

CG Darboe’s industrial tour, which began last week to evaluate the level of digital compliance, is expected to continue.