The Gambia Revenue Authority (GRA) has defended its decision to sign a duty stamp contract with Swiss company SICPA amidst criticism from various quarters. The Commissioner General of GRA, Yankuba Darboe, addressed journalists yesterday, stating that the criticism is unfounded and based on a misunderstanding of the contract’s contents.

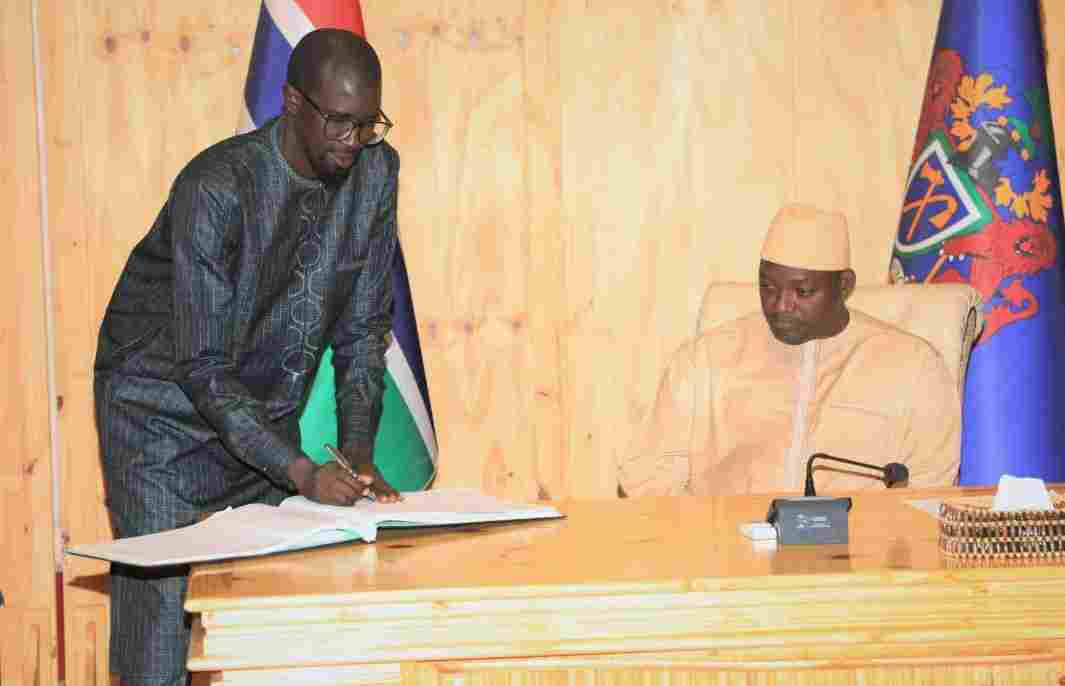

Darboe clarified that the contract with SICPA is a result of a public-private partnership and was awarded through an open tender process involving the Ministry of Finance, Office of the President, Gambia Public Procurement Authority (GPPA), and GRA. He emphasized that those criticizing the contract “have no idea what they are talking about.”

He explained that the contract includes three reform components aimed at introducing systems that have been successful in other countries and can benefit The Gambia. One of these components is the tax stamp, which manufacturers and businesses dealing with excisable goods are required to place on their products. This measure will allow GRA to track domestically produced products and ensure transparency and accountability in taxation.

Darboe noted that fees from businesses purchasing the stamps will be shared between the government and SICPA. He mentioned that companies like Gambega and GMC have already started using the stamps.

Fuel marking to stem fraud

The contract also covers fuel marking, with Darboe highlighting the challenges of detecting irregular fuel distribution. He stated that the SICPA fuel marking system will enable GRA to detect such abnormalities and ensure proper taxation of fuel products.

“All the fuel that comes into this country is dumped at the Mandinari depots, but the understanding we have is that there are some tankers that will come and stay at sea, and they will wait until night and use small vessels to distribute fuel to fuel stations. We cannot detect or verify these things, but with the SICPA fuel marking, if anything like that happens, we have testers that would be able to detect these abnormalities,” the commissioner general of the Gambia Revenue Authority, Yankuba Darboe, revealed.

Additionally, the contract addresses revenue assurance for telecoms companies, aiming to quantify excise tax and VAT elements generated by data and calls. Darboe emphasized the need for new initiatives to improve tax collection and support the country’s development.

In conclusion, Darboe defended the contract, stating that resistance to change is expected but emphasized the necessity of evolving tax collection methods to ensure the country’s development. He stressed that maintaining the status quo would hinder the collection of necessary taxes for national development.

The GRA’s contract with SICPA has sparked debate, with critics expressing concerns over its potential impact on prices of certain goods. However, GRA remains steadfast in its stance, asserting that the contract is essential for enhancing tax collection and promoting transparency in The Gambia’s economy.