Gambiaj.com – (BANJUL, The Gambia) – PetroNor E&P ASA is set to spotlight its offshore ambitions in The Gambia during its Annual General Meeting (AGM) scheduled for 29 May 2025, as the company seeks to reposition itself amid shifting legal, financial, and operational dynamics. Shareholders are expected to receive updates not only on the company’s promising A4 offshore block in The Gambia but also on lingering governance concerns stemming from ongoing legal investigations.

The company’s AGM will serve as a platform for PetroNor to address these issues head-on. As the company navigates boardroom battles and legal challenges, the AGM will be a crucial moment for PetroNor to regain investor confidence and solidify its position in the offshore oil and gas industry.

A4 Block in Focus: High Hopes for Gambian Exploration

At the heart of PetroNor’s upcoming strategy presentation is its 90% stake in Block A4, an offshore license in The Gambia that has gained traction within the company’s West African portfolio. Recently granted an 18-month extension, the license is located in a proven hydrocarbon basin and is backed by seismic data that suggest geological similarities to Senegal’s Sangomar Field — one of the region’s major oil discoveries.

According to CEO Jens Pace, the A4 block is “a technical work program with seismic attribute support,” laying the groundwork for a potential drilling campaign. While timelines remain fluid, the company is obligated to drill a well by 2026 as part of its license agreement.

However, PetroNor is actively seeking a farm-out partner to reduce its current 90% stake to somewhere between 30% and 50%. This move, common in the oil and gas industry, particularly in frontier regions like The Gambia, would allow PetroNor to share the significant costs and risks associated with deepwater drilling while retaining a meaningful interest in any potential discoveries.

Analysts view the farm-out strategy as a prudent financial move, particularly given PetroNor’s healthy balance sheet. The company ended 2024 with USD 140 million in oil sales, USD 79.7 million in cash, and no debt — a position that provides it with flexibility to seek value-accretive partnerships without compromising its financial stability.

Shareholder Returns and Legal Clarity on the Horizon

The AGM is also expected to address shareholder value initiatives, with speculation mounting about a potential payout following the earlier 2 NOK per share distribution in 2024.

Meanwhile, the meeting will be an opportunity for the board to offer more clarity on the company’s legal standing after a prolonged period of scrutiny by Norwegian and U.S. authorities.

Investigations by both the Norwegian National Authority for Investigation and Prosecution of Economic and Environmental Crime (Økokrim) and the United States Department of Justice (DOJ) were triggered by concerns stemming from corruption allegations following the company’s acquisitions in Africa.

While the U.S. DOJ formally closed its probe in April 2025 — citing both the information obtained and a sweeping executive order signed by President Donald Trump on February 10, 2025, suspending enforcement of the Foreign Corrupt Practices Act (FCPA)—the Norwegian investigation remains active.

The DOJ’s closure of the case offered a temporary reprieve to PetroNor, which has also been designated as a suspect entity by Økokrim, alongside its subsidiary, Hemla Africa Holding, in relation to charges of “misleading investors” during the merger and post-merger disclosure processes in Congo. PetroNor’s Oslo office was raided in December 2021, and the company has since initiated internal investigations.

Merger Fallout: Transparency and Governance in Question

The roots of PetroNor’s current legal entanglements lie in the probe into the acquisition of a 20% share in the Republic of Congo’s PNGF offshore block, as a result of which Hemla’s former executives were investigated by Norwegian authorities. In mid-December, Norwegian police detained Petronor’s then-CEO, Knut Søvold, as part of an investigation into suspected wrongdoing in the company’s Congo activities.

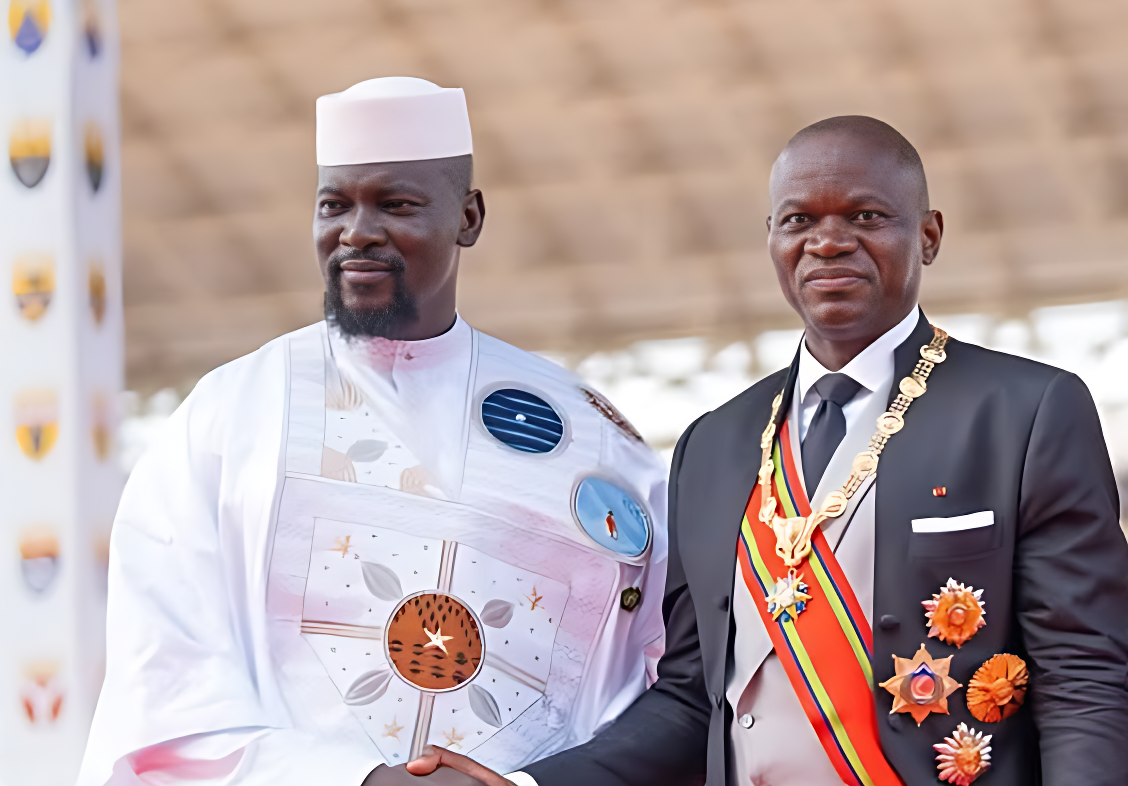

In a well-documented story on Investigate Europe showed how Julienne Sassou-Nguesso, the daughter of Congo-Brazzaville’s president Denis Sassou-Nguesso, secretly secured 15% ownership of a Petronor subsidiary, a minority partner in a lucrative drilling concession.

According to the report, Julienne Sassou-Nguesso was entitled to millions of dollars in income from Perenco’s oil field through a backroom agreement. Other participants in the system include the president’s son-in-law and the leader of a political party.

In The Gambia, specialists in the oil industry mirror the Congo Brazzaville case to the 2019 Petronor acquisition of African Petroleum — a deal structured as a reverse takeover that saw PetroNor, backed by Petromal and NOR Energy, gain 84% control of the company without triggering Norway’s mandatory takeover rules.

This was made possible by a rare exemption from the Oslo Stock Exchange, sparking concern over minority shareholder rights and regulatory oversight.

Critics argue that the transaction, far from being a merger of equals, amounted to a stealthy takeover that diluted African Petroleum shareholders to just 16% of the new entity. The aftermath saw PetroNor insiders dominate the boardroom and consolidating control.

Further dismay surrounded the issuance of 155.5 million African Petroleum Corporation Limited (APCL) Warrants and a matching set of PetroNor Warrants — opaque instruments that lack tradeability, clear vesting conditions, or guaranteed compensation upon expiration. This design has led to concerns about selective benefit allocation, particularly as management and consultants were awarded 8.5 million performance options.

Gambia and Senegal: The Unfolding Frontier

The A4 block update comes at a time when interest in the West African offshore basin is growing. The Gambia’s proximity to Senegal’s successful offshore plays makes it an attractive, though still high-risk, exploration frontier.

PetroNor’s efforts to bring in a technical and financial partner could provide the momentum needed to transition from seismic data to drilling.

Nevertheless, the company’s future in the region will depend not just on geology and partnership deals, but also on how convincingly it can clean up the reputational spillover from its merger history and legal scrutiny.

In that regard, PetroNor’s May AGM promises to be more than a routine shareholder check-in when looked upon from The Gambia. It will serve as a crucial juncture for a company straddling a high-stakes frontier play in The Gambia and the lingering shadow of controversial corporate practices.

With oil prospects, shareholder payouts, and legal transparency all in the mix, the outcome of this meeting could reshape investor confidence and determine whether PetroNor can drill ahead — both literally and figuratively — with conviction.