Gambiaj.com – (BANJUL, The Gambia) – The Gambia’s State-Owned Enterprises (SOEs) recorded improved financial results in 2024, cutting their aggregate net losses by half compared to 2023. Yet, persistent losses at key entities—particularly the National Water and Electricity Company (NAWEC), Gamtel, Gamcel, and GamPost—remain a major drag on public finances, posing significant solvency and fiscal risks to the state.

The Heavyweights of Loss-Making SOEs

The SOE Commission’s 2024 Aggregate Financial Performance Report shows that NAWEC alone accounted for GMD 2.3 billion in net losses, despite being the highest revenue earner in the sector with GMD 8.3 billion.

Its heavy reliance on costly Independent Power Producers (IPPs), lack of cost-reflective tariffs, and foreign exchange losses from imported fuel and equipment continue to undermine its financial health.

NAWEC shoulders 72% of total SOE obligations, with liabilities exceeding assets by GMD 5.5 billion, making it the single largest fiscal risk to the state.

Gamcel remains insolvent, posting a debt-to-asset ratio of 4.54—an indication of severe financial distress.

The mobile operator has been rapidly losing customers, struggling with outdated infrastructure, and spending 147% of its revenue just on administrative and personnel costs, a clear sign of unsustainability.

Gamtel, its parent company, also continues to bleed financially, burdened by extensive cable cuts during construction projects and increasing competition in fiber services. It shifted from positive equity in 2023 to negative equity of GMD 49.6 million in 2024 and carries GMD 1.37 billion in liabilities.

GamPost has seen revenue collapse after the termination of key international partnerships, while arrears to international postal bodies have further strained operations.

Its liquidity remains tight, with a cost recovery ratio of just 0.95 and arrears owed to bodies such as the Universal Postal Union (UPU).

Together, these four entities account for the bulk of SOE net losses, arrears, and solvency risks, threatening to reverse fiscal consolidation gains.

Solvency and Fiscal Risks

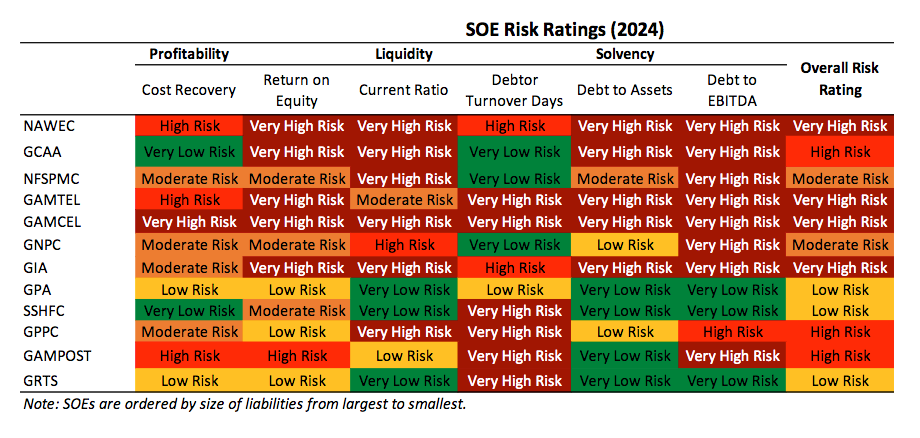

The report classifies NAWEC, Gamtel, Gamcel, and Gambia International Airlines (GIA) as “very high risk” SOEs due to a toxic combination of negative equity, liquidity shortfalls, and solvency challenges.

Gamcel is described as “insolvent” and unable to cover even monthly operating costs without bailouts. The report warns that delays in privatization or restructuring could force closure to prevent it from becoming a perpetual drain on government resources.

NAWEC faces solvency concerns on an unprecedented scale, with both current and long-term liabilities far exceeding assets. The Commission urges urgent reforms, including reducing dependence on IPPs and investing in renewable energy to cut costs.

Gamtel, despite generating revenue, faces long-term risks from outdated infrastructure and mounting arrears.

A new Public-Private Partnership (PPP) has been floated as a possible way forward.

GIA’s revenue collapsed by 56% in 2024 due to new competition from NIRO Airlines, loss of ground-handling contracts, and declining ticket sales.

In addition to these, GCAA, GPPC, and GamPost are rated as “high risk”, with moderate solvency concerns but still significant exposure.

Cross-Arrears and Inter-SOE Debts

The report highlights a troubling GMD 1.36 billion in cross-SOE arrears at the end of 2024. The largest arrears involve:

GNPC to NAWEC (GMD 567.8 million outstanding)

Gamtel to Gamcel (GMD 379.3 million)

SSHFC to NFSPMC (GMD 222.5 million)

Partial compliance with arrears settlement was noted, but several SOEs—including Gamcel, Gamtel, and GIA—remain unable to honor repayment schedules.

The Brighter Side: Profitable SOEs

Not all SOEs are struggling. The Gambia Ports Authority (GPA) turned around losses from 2023 to post a GMD 344 million profit in 2024, while the Social Security and Housing Finance Corporation (SSHFC) recorded a healthy GMD 344 million surplus.

The National Food Security Processing and Marketing Corporation (NFSPMC) also recovered strongly, moving from a GMD 60 million loss in 2023 to a GMD 61 million profit.

The overall SOE sector generated GMD 17 billion in revenue, up 13% from 2023, and cut net losses from GMD 2.9 billion to GMD 1.5 billion. Total assets rose to GMD 37.5 billion, representing 21% of GDP.

The SOE Commission recommends urgent restructuring of insolvent entities, including fast-tracking the privatization of Gamcel, reducing NAWEC’s reliance on IPPs, and exploring debt-to-equity swaps for SOEs burdened with unsustainable debt. Without such measures, the government risks escalating bailouts, further straining public finances.

One Response

Gampost is a disaster. As of 1st August, 2025 they upped the parcel handling fee from D100 to D500 – incoming and outgoing. One parcel shipped to me via China Post took 2-1/2 years to reach my PO Box. I’m still waiting to receive 4 parcels, each from a different vendor in China, that postal tracking services report arrived in Banjul 30 Sept 2024. To make matters worse, the Bakau office often does not have anyone on hand to sell me a postage stamp.