Gambiaj.com – (Dakar, Senegal) – Senegal is facing mounting financial pressure after credit rating agency Moody’s downgraded its sovereign debt to Caa1, triggering a sharp rise in bond yields and stoking fears of a possible debt restructuring.

On Monday morning, yields on Senegalese dollar bonds spiked, with those maturing in 2031 rising 24 basis points to 13.15%, while bonds due in 2048 climbed to 11.62%, according to Bloomberg data.

The downgrade, announced last Friday, signals deepening investor concerns about Dakar’s capacity to meet its obligations.

Moody’s explained that while the agency hopes Senegal can secure International Monetary Fund (IMF) support without resorting to restructuring, confidence in that outcome has weakened. “The country remains at risk despite all its efforts to avoid a crisis,” warned Leeuwner Esterhuysen, economist at Oxford Economics, in remarks to Bloomberg.

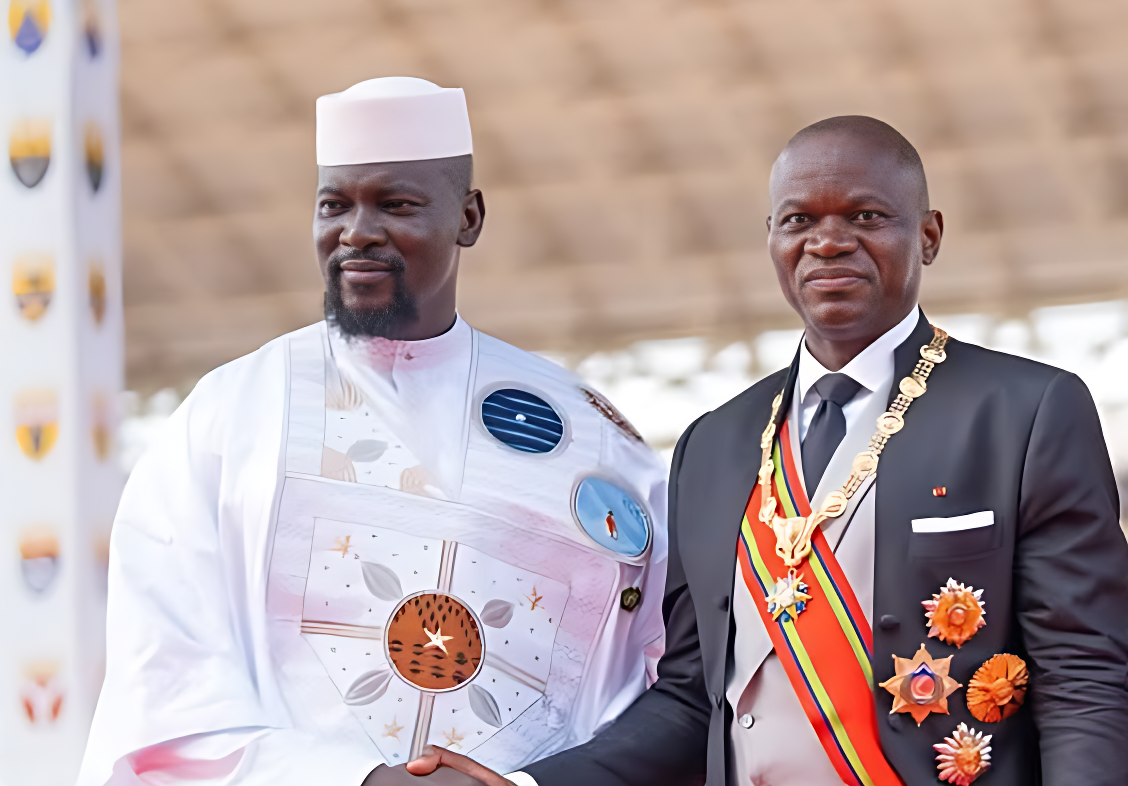

The turbulence follows a sweeping financial review by the new administration of President Bassirou Diomaye Faye.

The audit uncovered that the previous government had hidden $7 billion in borrowing, pushing Senegal’s debt-to-GDP ratio to 119% by the end of 2024. In response, the IMF suspended a $1.8 billion loan program, while both Moody’s and S&P Global Ratings further downgraded the country’s credit standing.

Analysts say Senegal now stands at a crossroads. “Senegal is walking a tightrope where the speed of resolution will determine future stability,” Esterhuysen added, underlining the urgent need for a credible plan to restore investor confidence and safeguard access to international markets.

With bond yields rising and international lenders on edge, the Faye administration faces a critical test in stabilizing Senegal’s economy and charting a path out of its growing debt crisis.

Meanwhile, Senegal has sent a large delegation to Washington for the Annual General Meetings of the International Monetary Fund and the World Bank, focusing on discussions on a possible “new program” with the IMF and the issue of hidden debt.

The delegation is led by Finance Minister Cheikh Diba, State Minister Al Aminou Lô, Energy, Petroleum, and Mines Minister Birame Souleye Diop, and Economy Minister Abdourahmane Sarr.