Gambiaj.com – (DAKAR, Senegal) – The International Monetary Fund (IMF) has firmly denied allegations made by Prime Minister Ousmane Sonko that the institution pressured Senegal to restructure its public debt, stating that any decision on debt management remains the sovereign choice of the Senegalese government.

The clarification was issued on Tuesday, a day after Senegalese eurobonds suffered one of their steepest declines in years.

According to Reuters, an IMF spokesperson said the Fund had discussed a range of technical options with Senegal to address what it described as “significant vulnerabilities in its debt” but emphasized that the IMF does not impose restructuring on member states.

“The choice and specific nature of debt operations, including whether or not to restructure debt obligations, remain a sovereign decision,” the spokesperson stressed.

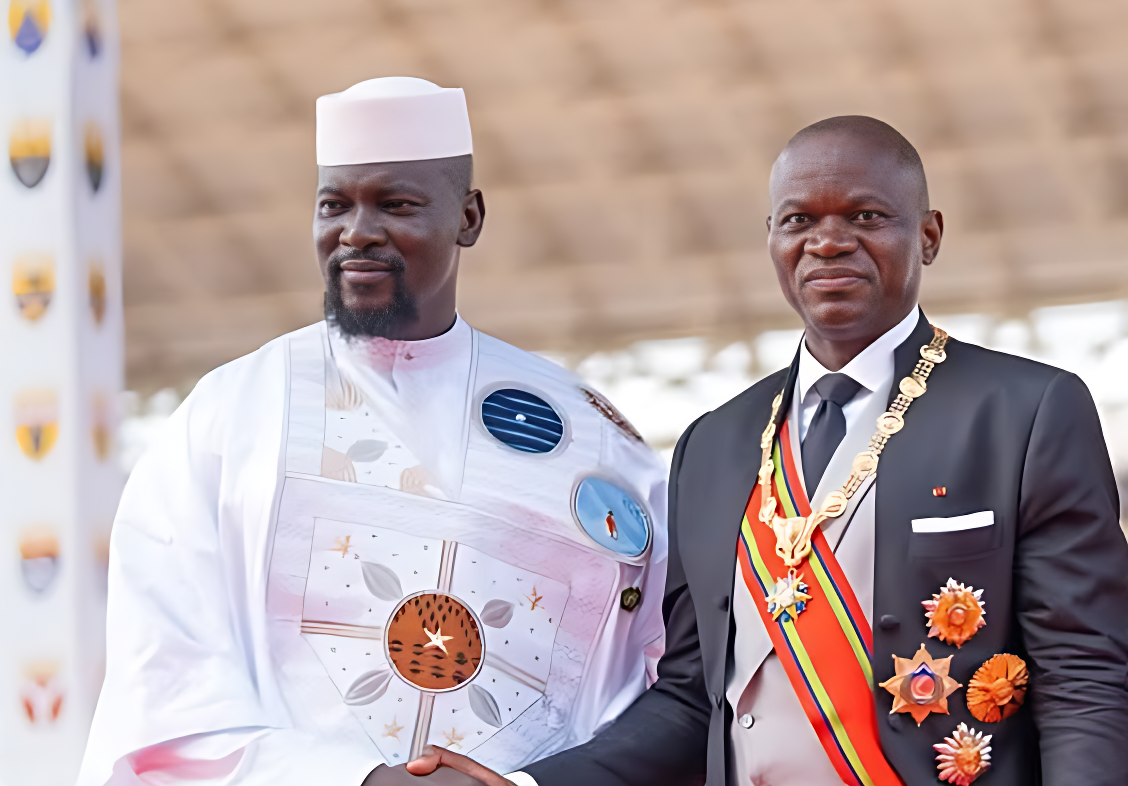

The statement directly counters remarks made by Prime Minister Sonko during a téra-meeting on Saturday, where he accused IMF officials of attempting to push Senegal toward a restructuring plan he said he firmly rejected.

Sonko argued that such a move could damage Senegal’s financial credibility, deter foreign investment, and expose the country to legal risks.

“Senegal will be perceived as a country on the verge of bankruptcy,” Sonko warned, adding that long-term consequences would outweigh any short-term relief.

The IMF mission that concluded in Dakar last week ended without agreement on a new loan program. The Fund noted that its role is to provide expert advice and analysis, not to dictate policy decisions.

This dispute comes against the backdrop of worsening investor confidence. On Monday, Senegal’s eurobonds experienced a sharp sell-off:

2031 bonds fell 4.3 cents to 72.6 cents, their worst performance since issuance.

2033 bonds dropped 3.3 cents to 66.1 cents, and

2048 bonds slid 2.4 cents to 61.6 cents, according to Bloomberg data.

Senegal’s previous $1.8 billion IMF program was frozen last year after the government acknowledged the existence of hidden debts now estimated at more than $11 billion.

The latest developments highlight growing uncertainty surrounding Senegal’s financial strategy and the government’s approach to restoring market confidence. As the situation evolves, attention is now turning to whether Dakar will seek a renewed agreement with the IMF, and on what terms.