NAIROBI/DAKAR, Nov 11 (Reuters) – Senegal will have to wait until at least June to get any sort of resolution of its lending programme with the International Monetary Fund that could lead to fresh disbursements, a source with knowledge of the process told Reuters.

There was no immediate comment from the finance ministry on the prospect of a delay that will be a test for a government seeking quick support to help it deal with an increasingly precarious fiscal situation.

A $1.9 billion IMF programme agreed in June 2023 has been on hold since a government audit three months later uncovered larger debt and deficit figures than the previous administration had reported, sending yields on the West African nation’s dollar bonds soaring and triggering credit ratings downgrades.

Dakar is seeking a new programme with the Fund, but the source said the IMF will not even consider the request before the audit findings, which are scheduled to be certified by Senegal’s court of auditors mid-December, are subsequently reviewed by the Fund’s executive board.

“They need to start by sorting out the issues identified in the audit,” the source said. Following the certification, the Fund’s board was expected to determine the next steps towards a resolution, a process expected to take another six months, the source added.

Senegal’s finance ministry did not immediately respond to a request for comment.

Senegal secured in June last year $1.526 billion under a three-year IMF Extended Fund Facility and Extended Credit Facility programme plus additional financing of $371.1 million from the Resilience and Sustainability Facility providing long-term concessional cash for climate-related spending.

Senegal got payouts of $216 million when it reached the loan agreement with the Fund and another $279 million in December last year after getting sign off on the first review by the executive board.

Subsequent reviews and IMF board sign-off, the step that ultimately triggers more payouts, have not been completed.

The IMF board is expected to consider various remedies for the misreporting, the source said, including demanding potential reimbursements for any loans advanced on the basis of the misreported data.

Another source confirmed a resolution would take “a few months”.

The Fund said last month it was assessing the implications of the data revisions.

Cash-strapped

Senegal had already been grappling with slower-than-projected growth and a worsening budget deficit before the revelations about the larger debt and deficit figures.

President Bassirou Diomaye Faye’s government reopened a privately placed international bond last month to raise $300 million.

Public debt averaged 76.3% of GDP, compared with the previously reported 65.9%, the audit found. The end-2023 budget deficit stood at over 10%, more than double the original indication.

“The hidden fiscal cost revelations under the previous government have raised markets’ concerns around Senegal’s debt sustainability,” JPMorgan said in a research note.

The yield on Senegal’s 2048 bond rose above 10% for the first time since early August, in the sessions following the release of the initial audit findings.

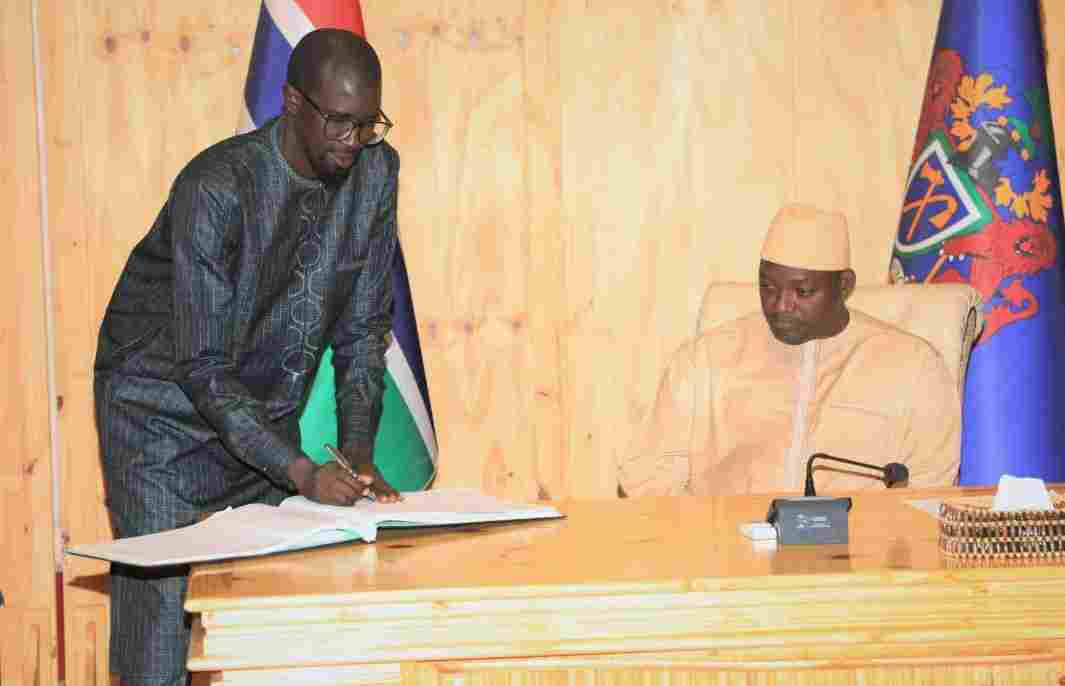

Faye, elected in March on the back of youth voters’ disenchantment with the previous government’s economic policies, has called a snap legislative election for Sunday.

He blamed the previous parliament’s refusal to initiate a new budget law, and its pushback against a plan to abolish wasteful state bodies for the move.

His Pastef party will need to secure a majority of the 165 seats to implement his economic reforms. Pastef held just 26 seats in the dissolved legislature.

Implications of misreporting to IMF generally make investors nervous. The Fund suspended disbursements to Mozambique in 2016 after it failed to disclose more than $1 billion in external loans.

Source: Reuters