Gambiaj.com – (Dakar, Senegal) – Senegal’s financial credibility has taken a major hit after Moody’s Ratings downgraded the country’s long-term credit rating to B3 from B1, citing massive undisclosed debt, weak fiscal transparency, and governance deficiencies inherited from past administrations. The move, announced on October 10, 2025, marks the second downgrade this year and places Senegal among the riskiest borrowers in emerging markets.

Moody’s justified the downgrade by pointing to an explosive audit report from the Court of Auditors, which revealed a far more precarious fiscal position than previously disclosed.

According to the audit, government debt stood at 99.7% of GDP in 2023—a staggering 25 percentage points higher than official figures. By 2024, Moody’s estimated debt had risen to 107% of GDP, one of the highest ratios among comparable economies.

The report also uncovered CFA 2.3 trillion in guaranteed debt—equivalent to 11% of GDP—four times higher than previously reported, adding heavy contingent liabilities to Senegal’s balance sheet. The audit accused the previous administration of engaging in extra-budgetary spending, non-regularized Treasury advances, and incomplete project accounting, fueling deep concerns over governance.

Moody’s kept Senegal’s outlook negative, warning of “high downside risks” linked to fiscal slippages, liquidity constraints, and dependence on external financing.

The agency stressed that restoring investor confidence will require strict fiscal consolidation, transparent debt management, and securing renewed support from the International Monetary Fund (IMF).

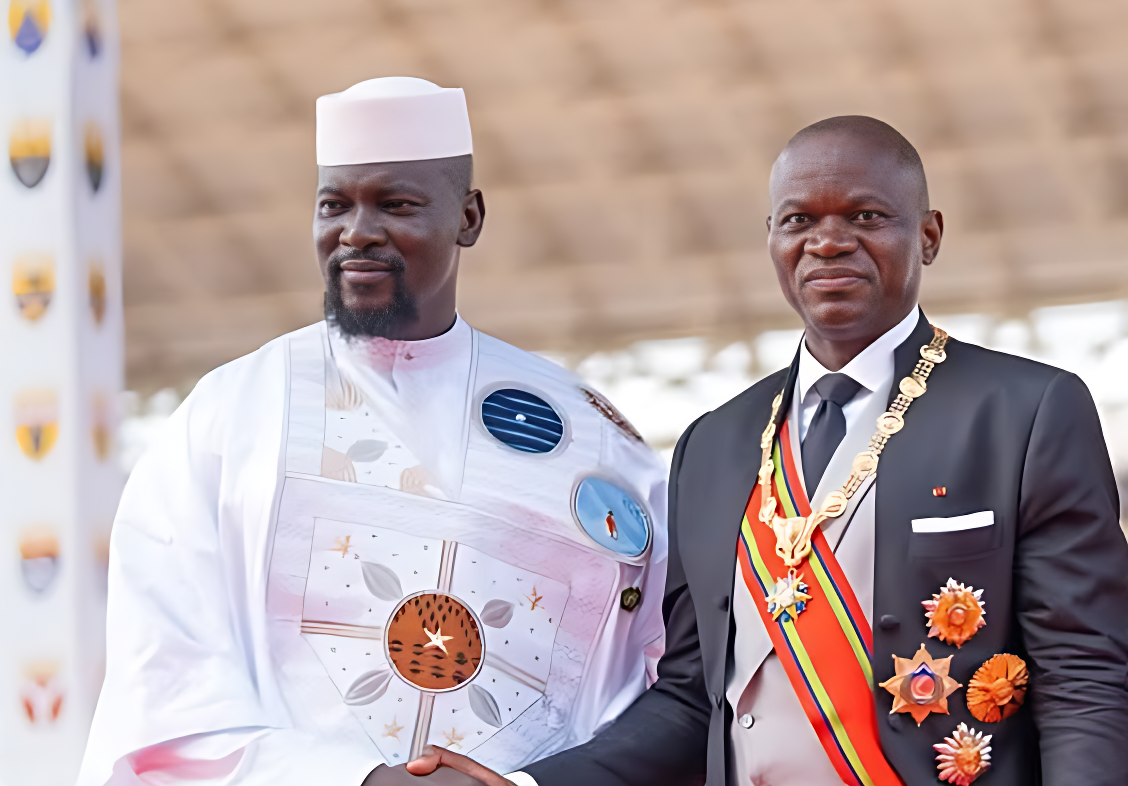

Senegal’s Angry Response

The downgrade was met with visible anger in Dakar. In a strongly worded statement, the Ministry of Finance and Budget rejected Moody’s findings as “speculative, subjective, and biased,” accusing the agency of ignoring Senegal’s real economic fundamentals and reform trajectory.

“The decision does not reflect the reality of our economy nor the bold policies being implemented to consolidate fiscal stability and ensure debt sustainability,” the government declared, denouncing what it called the “reckless initiatives” of rating agencies.

Authorities highlighted ongoing reforms under the Plan de Redressement Économique et Social (PRES), including a revised tax code and a new investment framework, as evidence of a shift toward greater transparency and sustainability.

They also pointed to diversified financing sources, including successful bond issuances on the regional market and expanding partnerships.

The Senegalese authorities further invoked controlled budget execution, with the mid-2025 deficit at CFA 588 billion and revenues already achieving 50% of targets.

They pointed to positive growth prospects, fueled by structural reforms and a booming energy sector.

The government urged investors to judge Senegal “on the basis of reliable information, balanced analysis, and objective facts,” reaffirming confidence in the economy’s resilience despite the downgrade.

Moody’s insists that stabilizing Senegal’s credit profile will hinge on the government’s ability to reduce the fiscal deficit, smoothen debt maturities, and rebuild credibility through transparent reporting.

Analysts note, however, that execution risks remain high given the scale of the debt problem and growing repayment pressures, particularly on the 2028 eurobond.

For now, Senegal finds itself caught between two narratives: Moody’s grim assessment of a country weighed down by hidden debt and the government’s defiant portrayal of an economy on the path to reform and recovery.