Gambiaj.com – (DAKAR, Senegal) – Senegal’s dollar bonds declined on Monday following a decision by S&P Global Ratings to further downgrade the country’s sovereign credit rating deeper into speculative territory. The move comes after an audit revealed a significantly weaker financial position than previously reported.

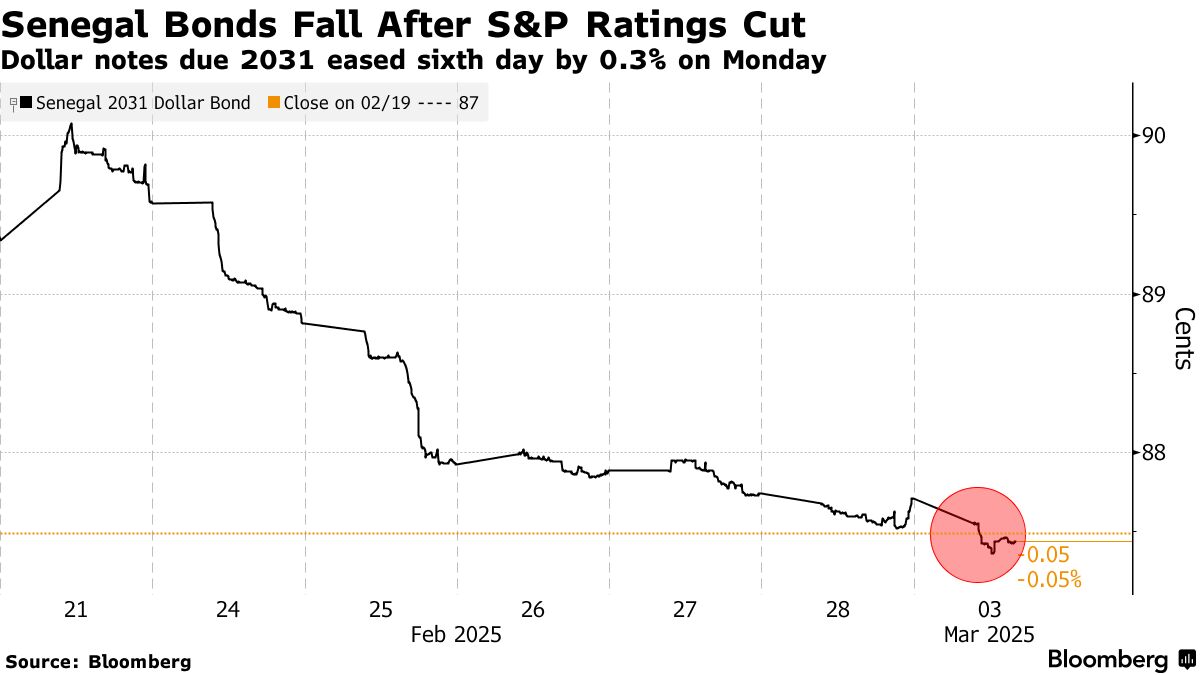

The West African nation’s Eurobond maturing in 2031 fell by 0.3% to 87.44 cents per dollar, while the 2048 maturity bond declined by 0.2% to 67.17 cents per dollar. The downgrade adds to concerns about Senegal’s fiscal stability, affecting investor confidence.

On Friday, S&P lowered Senegal’s long-term foreign currency credit rating to B, placing it five levels below investment grade. This follows a similar downgrade by Moody’s Investors Service last month, which cut Senegal’s rating by two notches to B3. The deteriorating credit standing reflects the findings of an official investigation into the nation’s financial situation.

President Bassirou Diomaye Faye, who took office after winning last year’s election, initiated a probe into the country’s economic management under his predecessor, Macky Sall. The investigation uncovered that the previous administration had presented overly optimistic figures on debt and deficits.

A report from Senegal’s Court of Auditors, published last month, revealed a dramatic increase in the country’s debt-to-GDP ratio, which surged from 65.6% in 2019 to a recalculated 99.7% in 2023. Additionally, the budget deficit for 2023 was found to be 12.3% of GDP—far higher than the 4.9% previously reported by the Sall administration.

“The figures for Senegal’s fiscal deficit and debt have been recalculated at significantly higher levels, with deficits between 2019 and 2023 now averaging twice the previously reported amounts,” S&P stated in its latest assessment. The agency warned that Senegal’s debt burden is expected to remain around 100% of GDP, constraining fiscal flexibility. It projected the fiscal deficit to stay elevated at approximately 6.5% of GDP from 2025 to 2028.

The revised fiscal data presents a major challenge for President Faye’s government as it seeks to restore investor confidence and implement policies to stabilize the economy. Analysts suggest that Senegal may need to pursue fiscal reforms and seek external support to mitigate the impact of rising debt levels and maintain access to international financial markets.