Gambiaj.com (Dakar, Senegal) – Senegal’s dollar-denominated sovereign bonds fell sharply on Friday following a cautionary statement by the International Monetary Fund (IMF), which signaled that resolving the country’s debt misreporting issue would be a “rigorous and long process.“

Data from Tradeweb shows that Senegal’s 2033 bonds lost 1.35 cents to trade at 67.72 cents on the dollar, while the longer-dated 2048 bonds declined by 1.12 cents to 59.97 cents.

The selloff underscores growing investor anxiety over the West African nation’s fiscal credibility and the stalled IMF bailout program.

The IMF froze its $1.8 billion support program for Senegal after the current government admitted that deficit and debt figures under the previous administration were significantly underreported. The revelations prompted an ongoing audit and a delay in disbursements, leaving markets in limbo.

“The market is very nervous about this credit,” said Leo Morawiecki, investment specialist at Aberdeen Asset Management in London. “We were promised final audit figures, a waiver, and a resumed IMF program, but the dates keep slipping.”

Investors had hoped for a resolution or at least a firm timeline by mid-2025. However, during a press conference on Thursday, IMF Communications Director Julie Kozack said the process was still underway without offering a specific timeframe.

“We continue to work with the authorities to resolve the complex case of misreporting. It requires a rigorous and long process,” she explained.

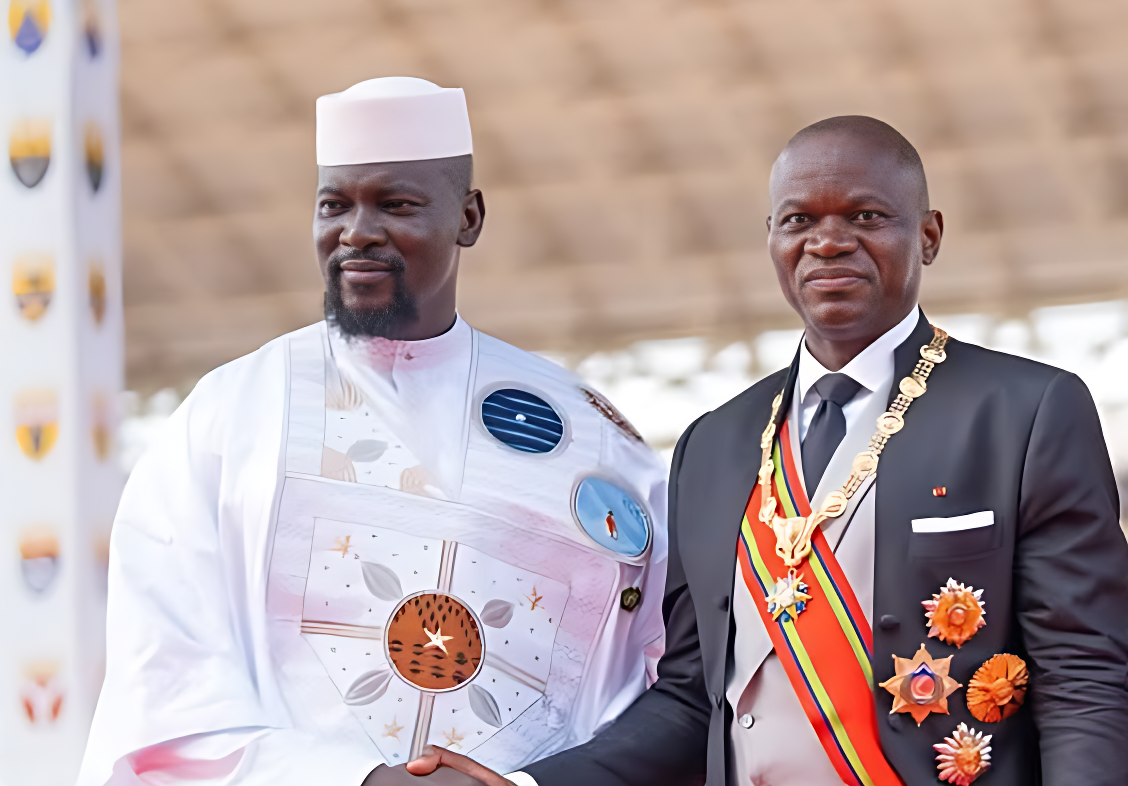

The uncertainty has cast a shadow over Senegal’s economic outlook just as the new government seeks to rebuild credibility with international creditors and financial markets.

Without a resumed IMF program, the country may face rising borrowing costs and challenges in accessing external financing, particularly ahead of upcoming debt service obligations.

Meanwhile, in the broader markets, the downturn in Senegalese bonds contrasted with mixed performance across global equities and commodities.

Oil prices surged, with Brent crude up 5.85%, while major tech stocks like Nvidia and Ubisoft saw notable losses. Bitcoin also dipped 1.24%, amid a wider cryptocurrency pullback.

Senegal’s economic partners and investors will be closely watching the pace and transparency of the government’s cooperation with the IMF as the country navigates a politically sensitive and financially critical period.