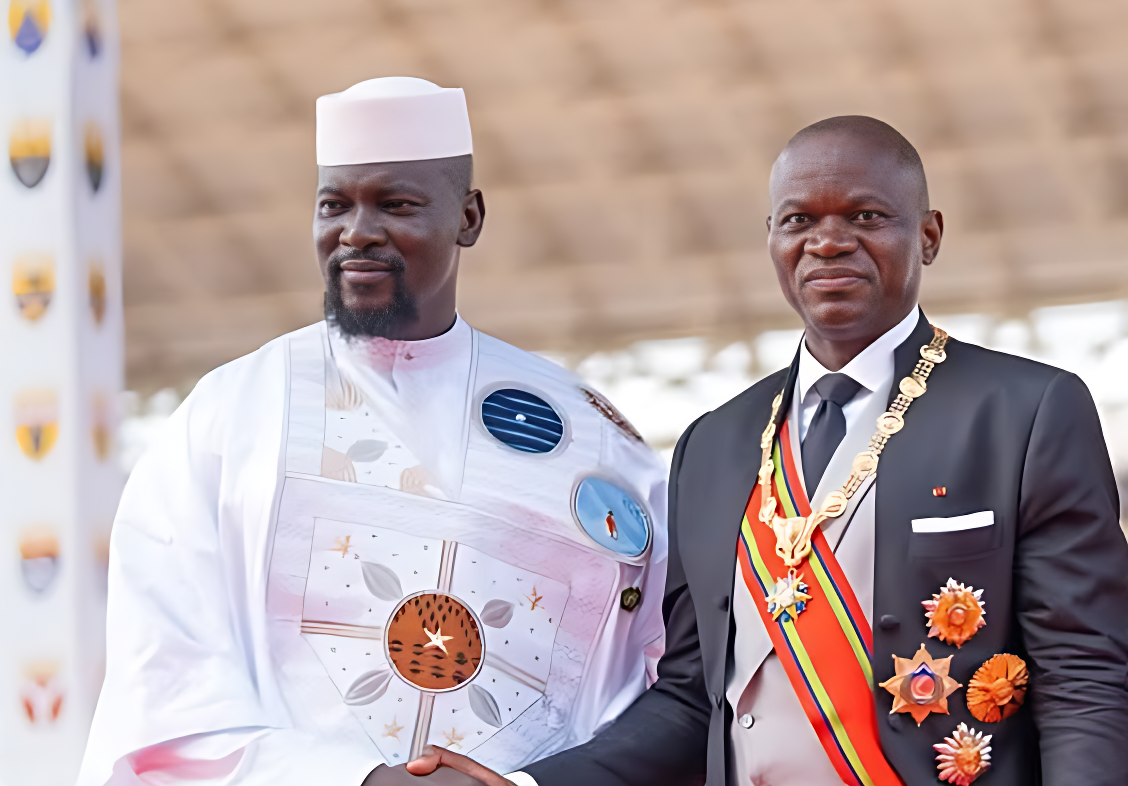

Gambiaj.com – (LONDON, United Kingdom) – Senegal’s new government, led by President Bassirou Diomaye Faye, has taken a bold step that is creating waves in the international business community. London based Global Finance Magazine has looked into the Senegalese government newly established commission to audit the country’s natural resource agreements, with the goal of “reexamining and rebalancing” these contracts to better serve the nation’s interests.

This decision comes on the heels of Senegal’s official entry into the league of oil-producing nations. In June, Australian company Woodside Energy began oil extraction from the Sangomar offshore field, a $5.2 billion project in which Woodside holds an 82% stake, with Senegal’s state oil company, Petrosen, owning the remainder.

Global Finance Magazine reports that Woodside is just one of several multinational corporations heavily invested in Senegal’s natural resources. Other key players include BP, Kosmos Energy, Total, Oranto, Endeavour, Managem, and Dangote. BP, which operates the $4.8 billion Greater Tortue Ahmeyim gas project, is expected to make its first gas delivery this year, contributing to an anticipated $1.4 billion annual petrodollar windfall for Senegal.

The audit has sparked concern among these multinationals. As Global Finance Magazine notes, while the government’s stated aim is to enhance transparency and foster trust between the state, foreign companies, and the public, the true motives behind the audit remain unclear, leading to uncertainty about the future of existing agreements.

“Senegalese people want tangible benefits from natural resources and demand efficient use of profits,” Global Finance Magazine says Catherine Lena Kelly, an associate professor at the Africa Center for Strategic Studies in Washington, as saying. Kelly suggests that the audit, in theory, could lead to fairer deals that benefit both the Senegalese populace and international investors.

Despite the government’s assurance that there are no plans to nationalize ongoing projects, Global Finance Magazine highlights the growing anxiety among foreign companies. The audit, combined with the destabilizing effects of recent regime changes across Africa, has made multinationals wary of the potential risks. Patrick Obath, a Kenya-based energy and mining expert, told the magazine, “Expect arbitration clauses to become watertight, because investors abhor the uncertainties of regime changes.”

Drawing comparisons with other African countries, such as Tanzania, which have recently overhauled existing resource agreements, Global Finance Magazine warns that Senegal might be venturing into dangerous territory. The magazine cautions that the outcome of this audit could have significant implications for the future of foreign investment in Senegal’s oil and gas sector.