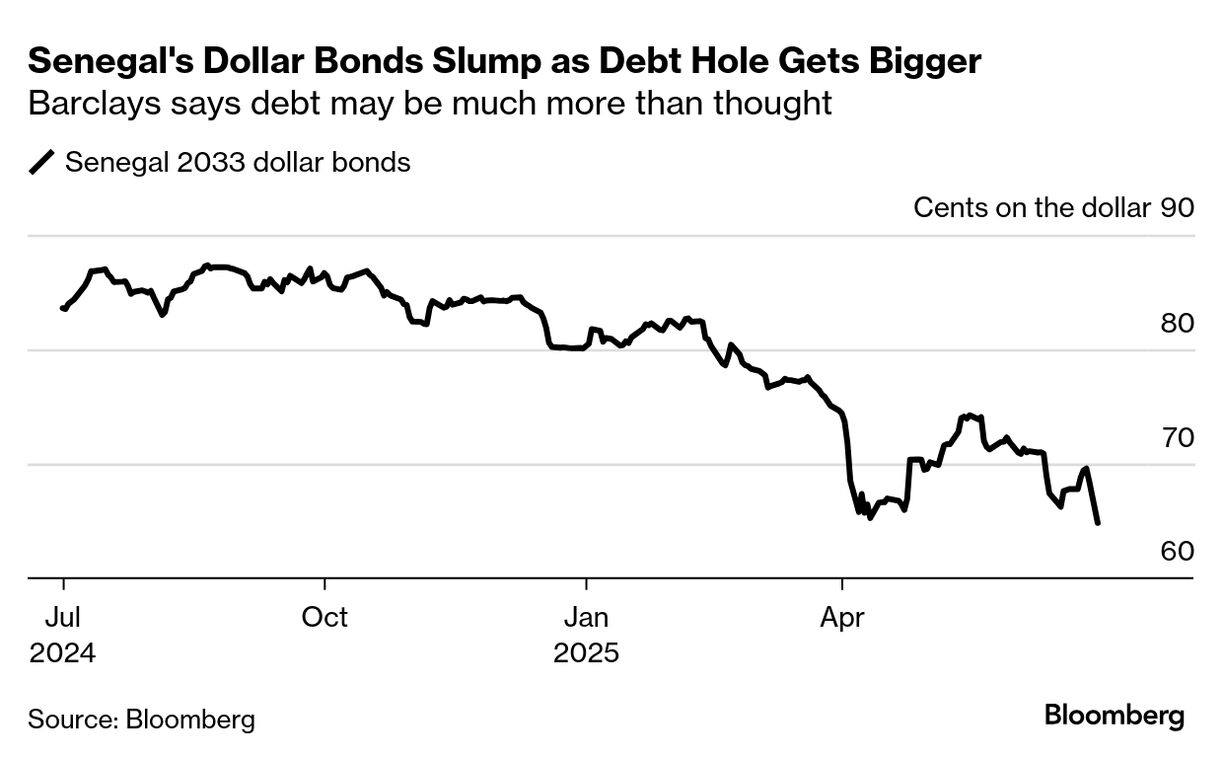

Gambiaj.com – (Dakar, Senegal) – Investor confidence in Senegal’s sovereign debt has taken a fresh hit, with the country’s dollar-denominated bonds now ranking among the worst-performing in emerging markets, according to a Bloomberg analysis published Monday. The selloff follows a Barclays PLC report revealing that Senegal’s public debt skyrocketed to 119% of GDP in 2024 – far above the 99.7% figure estimated by the country’s Court of Auditors last year.

The implications of the report are significant. Senegal’s bond market, already under scrutiny since the September 2024 revelations of account falsifications under the previous administration, is now facing intensified skepticism from international markets.

With sovereign bonds maturing in 2033 and 2048 falling further – already priced at 84.54 and 67.17 cents on the dollar respectively last year – Barclays’ findings have only reinforced investor fears.

“This new data presents fresh risks to Senegal’s debt trajectory and is likely to complicate ongoing discussions with the International Monetary Fund,” analyzes Michael Kafe, economist at Barclays, in his report.

He emphasizes that this development “makes Senegal the most indebted country in Africa and one of only three on the continent” with a debt-to-GDP ratio exceeding 100% in 2024.

Barclays’ latest projections paint a particularly grim outlook for the Senegalese economy. According to Kafe, it could take “almost a decade for Senegal to bring its debt burden back below the 100% threshold“—a significantly longer timeline than the bank’s previous forecast, which anticipated a return to double-digit debt levels by 2028.

The situation is further worsened by rising exchange rate risks. The proportion of Senegal’s public debt denominated in foreign currencies increased from 63% in 2023 to 71% in 2024, leaving the country more vulnerable to international currency fluctuations.

The fallout comes at a time of acute fiscal strain. Senegal’s budget deficit is projected to remain elevated – averaging 6.5% of GDP between 2025 and 2028 – raising red flags over the country’s capacity to stabilize its finances without major external support.

The Barclays report underscores Senegal’s growing dependence on external financing and notes that ongoing negotiations with the International Monetary Fund (IMF) have yet to yield a finalized new loan program, further compounding uncertainty.

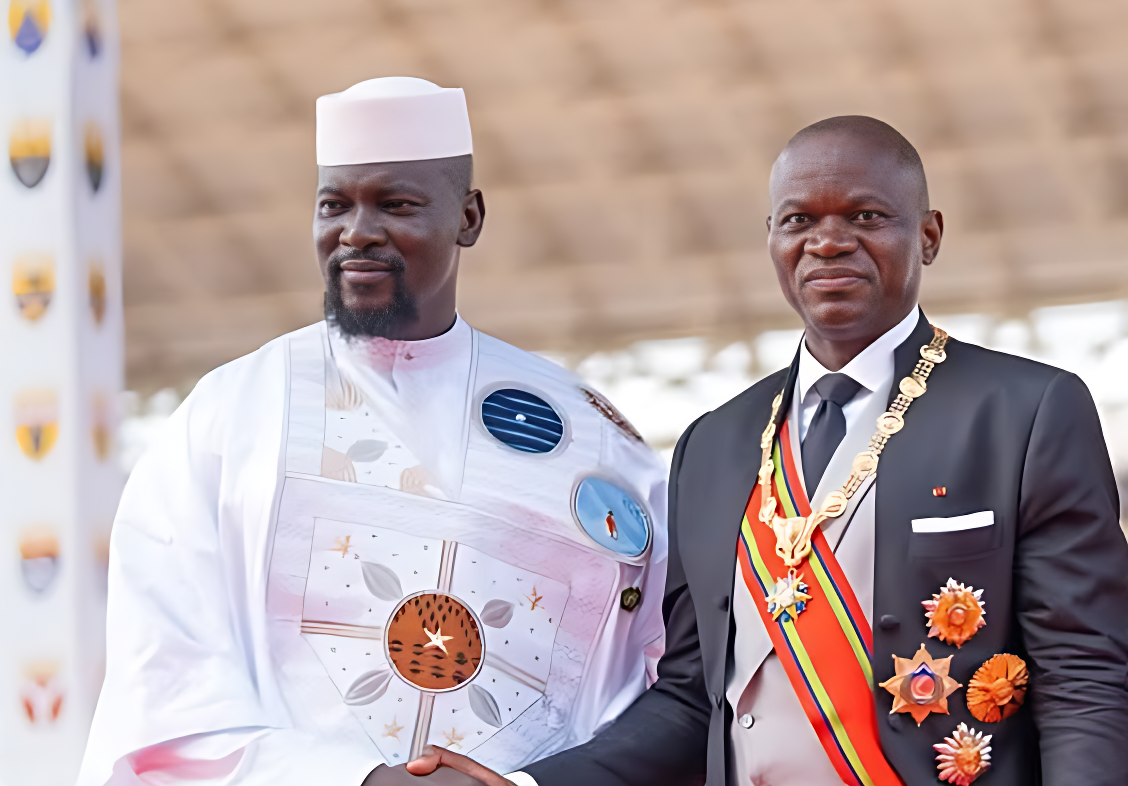

This financial unease intersects with a turbulent political backdrop. Since assuming office in March 2024, President Bassirou Diomaye Faye and Prime Minister Ousmane Sonko have embarked on sweeping institutional reforms aimed at resetting the country’s governance model.

However, the controversial dissolution of the National Assembly last year, intended to accelerate reforms, has triggered domestic tensions and raised questions among investors about the government’s ability to govern effectively during a delicate transition.

In March 2025, S&P Global Ratings downgraded Senegal’s sovereign credit rating to “B,” placing the country five notches below investment grade.

At the time, the agency cited both political risks and structural economic vulnerabilities as contributing factors. This latest report by Barclays appears to confirm those concerns.

A Barclays analyst, speaking to Bloomberg, warned that “the upward revision of the debt/GDP ratio highlights major structural challenges for Senegal.”

The remark captures the growing unease in financial circles: beyond headline debt figures, the underlying sustainability of Senegal’s public finances is in doubt, especially with donor confidence wavering and growth momentum at risk.

As Senegal pushes forward with reforms and grapples with fiscal recovery, the next steps—particularly any resolution with the IMF—will be critical. For now, the markets are signaling more pain ahead.