Gambiaj.com – (BANJUL) – In the ever-evolving landscape of global beer consumption, The Gambia has emerged as a standout in beer tax rates. A recent report by Insider Monkey reveals that The Gambia tops the list in Africa and ranks sixth globally, with beer taxes standing at a notable 50.17%.

To collect data for this ranking, Insider Monkey referred to the Global Health Observatory of the WHO, looking for the Countries with the Highest Beer Tax. Insider Monkey is an investing website that tracks the movements of corporate insiders and hedge funds.

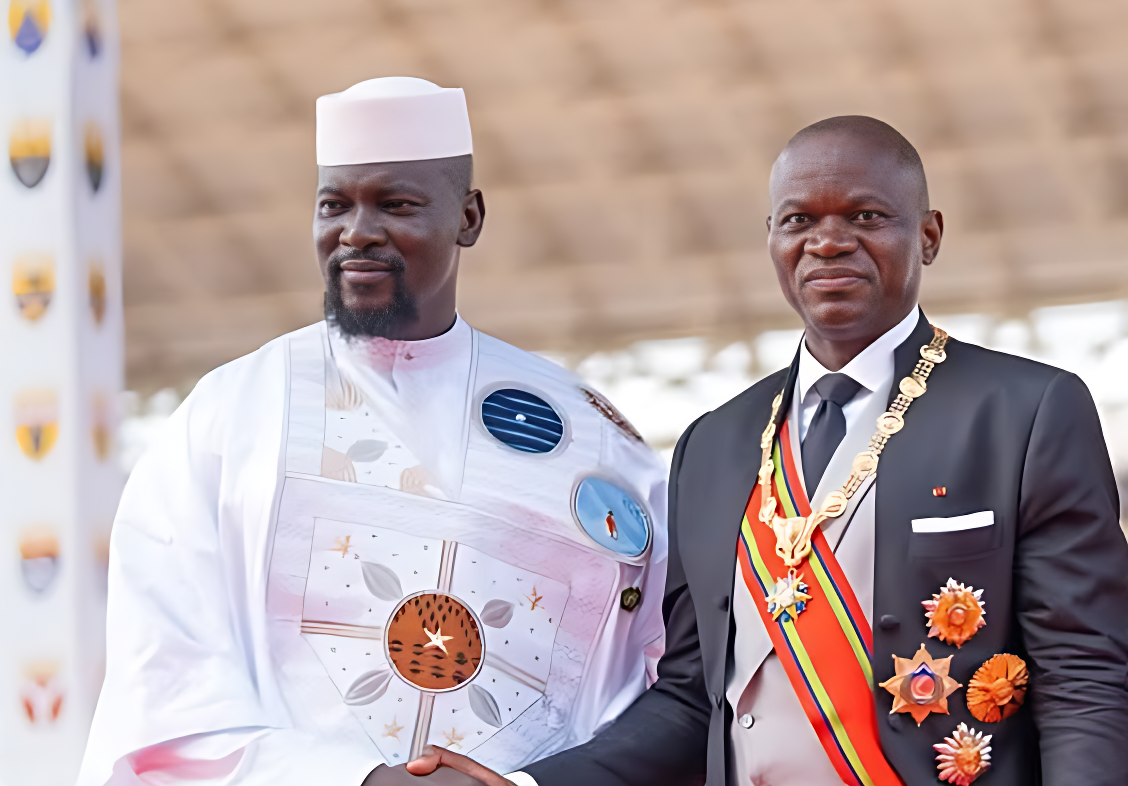

The position of The Gambia is the result of president Adama Barrow’s government decision in 2019 to increase wine and beer taxes by a staggering 75%. However, intense lobbying efforts by major alcohol producers, including Banjul Breweries owned by the French brewer, Castel Group, led to a reversal of this decision. The breweries had threatened to cease operations in the country, putting significant pressure on the Finance Ministry.

After months of negotiations, the tax rate was reduced to 35% and before climbing now to 50% at import. This incident had a lasting impact, leading to the cessation of Julbrew, which was paying 3.7 million euros in taxes annually. Officially, the decision was attributed to the business’s lack of profitability, requiring heavy investment for production maintenance.

Furthermore, with the tourism sector severely impacted by the economic crisis from the coronavirus outbreak, Banjul Breweries ceased ordering raw ingredients. Despite this, the Julbrew brand continues, now brewed in Dakar, in the vats of the West African Brewery Company (SOBOA).

This case underscores the delicate balance between government revenue generation and the interests of key industries. While high taxes can bolster government coffers, they also risk alienating crucial businesses and investors.

The Gambia’s experience serves as a reminder of the intricate interplay between policy-making and economic interests in the global beer market.