Gambiaj.com – (Banjul, The Gambia) – The Gambia has recorded a fiscal deficit of GMD 1.455 billion in the first quarter of 2025, according to the latest Budget Performance Report released by the Ministry of Finance and Economic Affairs (MoFEA). The report, which reviews government revenues, expenditures, and financing trends as of end-March, highlights both positive gains in tax revenue collection and concerning shortfalls in non-tax income and rising spending.

The deficit represents a sharp deviation from the approved annual budget’s target deficit of just GMD 198.3 million.

Revenue Collection Improves, But Gaps Remain

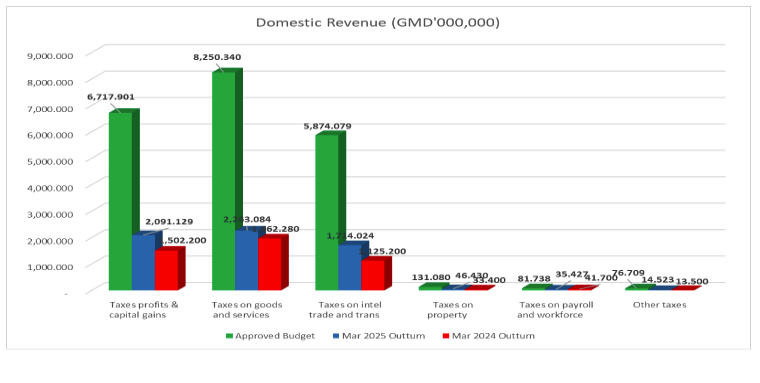

Total revenue (excluding project grants) for the quarter stood at GMD 6.675 billion, accounting for 21% of the annual revenue target of GMD 32.1 billion. This reflects a 19% increase—or GMD 1.087 billion—over the same period last year, largely driven by robust tax performance.

Tax revenues rose to GMD 6.164 billion, a 32% year-on-year increase, buoyed by a surge in corporate and personal income taxes, customs duties, and VAT. Taxes on international trade, in particular, saw a 52% increase, attributed to improved customs administration and digitalization efforts.

However, non-tax revenue fell sharply by 44%, totaling just GMD 510 million, well below the GMD 7.96 billion annual projection. The report attributes this decline to reduced income from Ministries, Departments, and Agencies (MDAs).

No programme grants or budget support were received during the quarter.

Spending Rises, Driven by Transfers and Debt Servicing

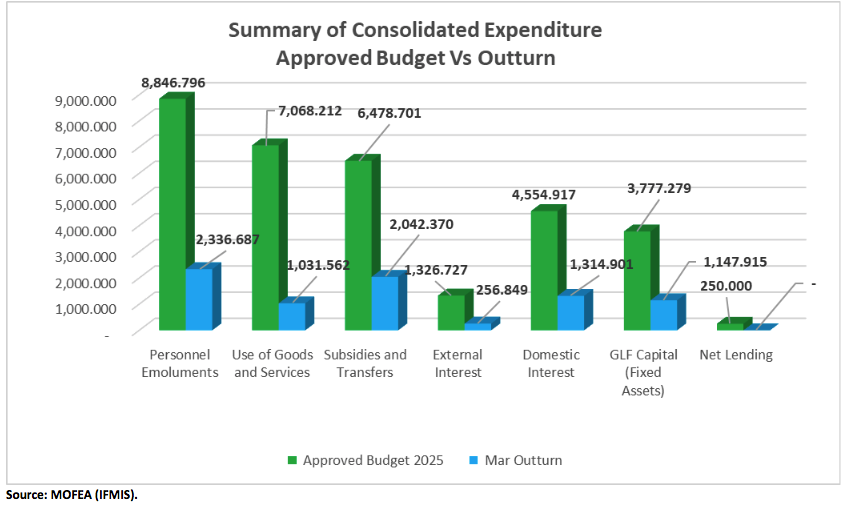

Government expenditure and net lending under the Government Local Fund (GLF) reached GMD 8.13 billion, or 25% of the approved annual allocation of GMD 32.3 billion. This represents a 12% increase compared to the first quarter of 2024.

Current expenditures were pegged at GMD 6.98 billion, including personnel emoluments of GMD 2.34 billion—up 29% year-on-year, reflecting civil service pay increases. Subsidies and transfers surged to GMD 2.04 billion, a 24% rise, driven by rising costs in health, education, and social sectors.

Debt interest payments totaled GMD 1.57 billion, up 8% from last year, with GMD 1.33 billion also paid toward principal debt obligations.

Capital expenditure for the quarter stood at GMD 1.15 billion (30% of the annual budget), marking a modest 9% year-on-year increase.

Top Spending Ministries

Debt servicing consumed the largest share of spending at 31%, followed by the Ministry of Basic and Secondary Education (15%), the Ministry of Transport, Works, and Infrastructure (8%), and the Ministry of Agriculture (8%). Together, the top ten spending ministries and entities accounted for 89% of GLF expenditures.

Notably, subventions to public education institutions declined by 24% compared to the same period in 2024, while subsidies to agricultural institutions grew by a staggering 73%.

Financing the Deficit, Recommendations, and Outlook

To cover the GMD 1.455 billion deficit, the government resorted to domestic borrowing and funds from the Central Bank of The Gambia under the Extended Credit Facility (ECF). Though slightly improved compared to the GMD 1.284 billion deficit recorded in Q1 2024, the current gap still poses risks to fiscal stability.

The ministry has called for enhanced revenue mobilization and tighter expenditure controls to avoid overspending and maintain fiscal discipline. It also urged that financial transactions outside the Government Integrated Financial Management Information System (IFMIS) be avoided to reduce fiscal risks.

The report concludes that while The Gambia has made commendable progress in tax revenue collection and transparency, sustained efforts are needed to control spending and improve non-tax revenue performance to safeguard the country’s economic outlook for 2025.